If you are a price action trader, the first thing you want to see on a chart is a candlestick pattern. If a good candlestick pattern appears with the right context nothing can hold you from making money. Doji Candlestick Pattern is one of them.

So, let’s discuss about Doji Candlestick Pattern.

In price action point of view, neither bulls nor bears own the candle. Bulls try to push the price higher and bears try to push the price lower. But eventually, they fail and the candle closes near its open. So, Doji’s are one bar trading range.

This is what most traders know about a doji.

But the fact is that, doji’s are great reversal pattern. It is a single candle reversal pattern.

Table of Contents

How to identify a doji candlestick pattern?

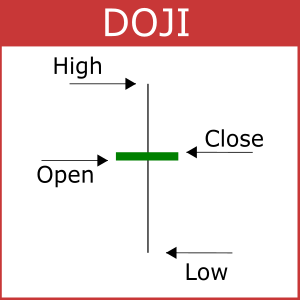

- The open is equal to (or almost equal to) the close. This is the first characteristic of a doji candle.

- Having no real body or a very tiny body in comparison to the candlewick.

- Big wicks on both sides or on top or bottom.

This is an example of a doji candle.

Do you know how many types of doji candles are there?

Let’s discuss…

Types of Doji Candlesticks

There are many types of doji candles and they have lots of names.

Here we are discussing only three types of doji candlesticks.

- Spinning top

- Dragonfly Doji

- Gravestone Doji

Doji’s are both continuation pattern and reversal pattern.

Our focus is on Doji candlestick reversal pattern.

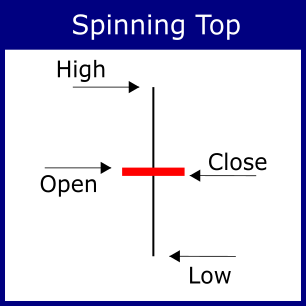

What is Spinning top reversal pattern?

Spinning top reversal pattern candlestick has wick on both sides and a non existent body in the middle of the candle.

Here is an example of a Spinning top reversal candle.

But, always remember! Candlestick patterns should not be picture perfect. If a candlestick is close enough to a pattern, you can trade it like that pattern.

Wait…

Just don’t jump into a trade as soon as you see a candle pattern.

There are lot more things to consider before taking a trade.

Before trading a pattern the context in which it has appeared is important.

How to trade a spinning top reversal candle?

Look for a spinning top only at key support and resistance levels.

- High of the previous day

- Low of the previous day

- High of current day

- Low of current day

- At a swing High

- At a swing Low

In a trending market you can trade a spinning top candle after a two legged pullback near or below 20 period moving average.

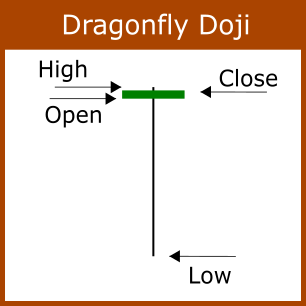

What is dragonfly doji candlestick pattern?

Dragonfly Doji is a bull reversal pattern. Having a large wick at the bottom and a non-existant body at or close to the top of the candle.

Here is how it looks like.

Where to look for a dragonfly doji candle?

- Low of previous day

- Low of current day

- At a swing low

- Near EMA in a pullback in an uptrend.

This is an example of a dragonfly doji on chart.

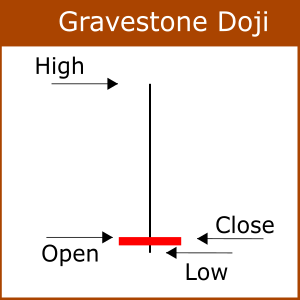

What is gravestone doji candlestick pattern?

Gravestone doji is a bear reversal pattern. Having a large tail on top and a non existant body at or close to the bottom of the candle.

This is how it looks like.

Where to look for a gravestone doji candle?

- High of previous day

- High of current day

- At a swing High

- Near EMA in a pullback in a downtrend.

This is an example of a gravestone doji on chart.

How to enter and exit a trade?

- Once you see a bullish setup, place a stop loss buy order. If the order is filled place a stop loss sell order below the candle with a little buffer.

- If you see a bearish setup, place a stop loss sell order. After the order is filled place a stop loss buy order above the candle.

- Also place a limit order at nearest swing high or low for exit.

If you have any question, feel free to drop in the comment section below.

Very thorough knowledge and research. Thanking you for this article. Please write more articles.

Thank You

It’s better to gain knowledge about ur investment

Thanks for reading my post.

One of the best analyses of the Doji candlestick pattern. Keep adding more such content!

Thanks for your motivation.

The best analysis……keep it up…

Thanks

very easy explanation thank you so much sir.